One of the most common questions that aspiring investors ask is – where do I find good stocks to invest in?

First of all, I think we need to remind ourselves that we are buying a share in good businesses at a fair price. Think of the greatest investor of our generation Warren Buffett’s Value Investing. This is a mindset shift vs the traditional way investors think. They always think they are buying a stock which fluctuates in price every second. When you start to shift your focus to being a business owner, you will start to see amazing results in your investments.

Good Businesses and Leaders

Picture this…how does it sound if today the following 3 very successful entrepreneurs offer you an irresistible price to own a share in their businesses. Do you recognise who they are and the businesses they run?

The amazing part of investing is we are able to be shareholders of good companies run by the best business leaders in the world. [Above: Jeff Bezos (Amazon), Warren Buffett (Bershire Hathaway), Mark Zuckerberg (Facebook)]

Gems in daily life

So where do we find good stocks to invest in? The simple answer is – it is actually in our daily life. We can actually find some gems if we are observant and curious to check out things which we use everyday. Some examples:

- What are the sports apparels you wear? Nike, Under Armour, Adidas…

- What food do you eat? Bread, Cheese, Starbucks coffee, restaurants you visit…

- Which mobile phone do you use? Apple, Samsung, Huawei…

- Or do you take the public transport? Comfort Delgro, SBS Transit…

- Where are the places you shop or work? Capitaland malls, Raffles place offices…

The list goes on. You will discover that there is no lack of investment opportunities. Start putting together a list of businesses you would like to review and then move to the next step by doing in-depth research to find out if they are good businesses. Remember, the businesses may be good but we also want to be paying a fair price for them.

Valuation methodology

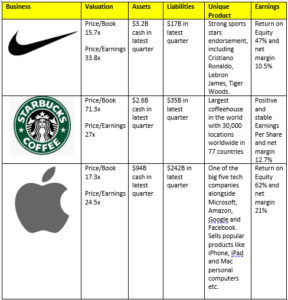

Generally, most investors who just start out tend to use their “gut feel” or listen to stock tips from others. Let us use a more structured yet simple approach, which is not too daunting, for new investors to start uncovering gems. I call it the V.A.L.U.E. approach:

Valuation: Remember we want to buy good companies at fair prices, not any prices (overvalued)

Assets: Includes cash and inventory which can be quickly converted to cash

Liabilities: Bank loans and money owed to suppliers

Unique Product: In Warren Buffett’s term – MOAT. A company’s competitive advantage

Earnings: Sustainable and growing

With the earlier examples on things we use everyday and the V.A.L.U.E. approach, let’s look at a few businesses and see if they are worth investigating further.

Before proceeding, I will like to share with you the free online tool that I use for analysis. It definitely makes our life easier.

Morningstar: https://www.morningstar.com/

Just go to our best friend – GOOGLE…type in [company name] Morningstar. And there you go!

I am sure many will agree with me that Nike, Starbucks and Apple are products which we come across and use in our daily life. I can almost safely assume that 99% of consumers will use 1 (if not more) of the 3 products. If you look deeper behind these brands, these are actually great businesses with strong moat (competitive advantage) and market leaders in their respective sectors. There are in fact many such businesses if you observe carefully. Hence there is no lack of choices for investments – look no further than things around you.

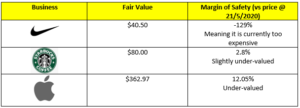

What price do you pay

Once we shortlist some of the interesting businesses which we would like to own, the next and most important step is to determine a fair value to pay for the stock. This is the interesting but also difficult part as it may require some judgement. We do not want to end up over-paying for something, just like the way you will always wait for the Great Singapore Sales to snap up that item which you have always wanted to buy. We all love a bargain and this approach should be applied in investing – buying things for a discount to the perceived value.

For beginners, I recommend using a simple system which you can follow and get going on this investing journey.

I will introduce you to another free tool which I use: Gurufocus: https://www.gurufocus.com/

I love their Discounted Cash Flow (DCF) calculator which shows you the Fair Value and Margin of Safety (Warren Buffett’s favourite numbers). Go play with it and have fun.

Back to the 3 stocks highlighted earlier. I ran a quick analysis using https://www.gurufocus.com/. Summary of the results below for your reference:

The key to fair value and margin of safety are that they are indicative values for your reference. Just like what you will do with buying things, always go for a reasonable bargain so you have a bigger buffer.

Conclusion

So I hope by now you are excited to start hunting for businesses which sells products and services you are familiar with. You will also have a simple system to follow to evaluate whether the businesses have good financials and more importantly pay the right price for them. Start small, look around you to find good stocks to invest. Hope you will start to enjoy the journey into the world of investing in great businesses!

Disclaimer – The stocks mentioned in the article are purely for education purpose. I am not making any Buy / Sell recommendation.

Like!! Great article post.Really thank you! Really Cool.

Like!! Great article post.Really thank you! Really Cool.