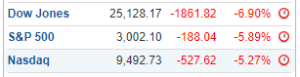

I woke up this morning to the news that US Indices plunged an average of 6% overnight. This was such a twist to my recent post when i just described how the markets rallied despite us being in the midst of the worst crisis in recent history. Is this the end of the dead cat bounce which the bearish camp had been calling? What should you do and should you panic?

Why did it crash?

Firstly, the number of coronvirus cases in the U.S. surged past the 2 million mark with 116,000 deaths. This spooked the market on the potential wave 2 infection.

Secondly, Federal Reserve Chair Jerome Powell warned that the US faces a “long road” to recovery. Predictions released by the Fed on Wednesday show policymakers expect the US economy to shrink 6.5% this year and the unemployment rate to be 9.3%. That is a big increase from the 3.5% rate recorded in February.

What should you do?

The FOMO (Fear Of Missing Out) feeling is strong among the investors who missed out on the rally since the markets bottomed on 23-Mar-2020. The desire to buy during such plunge is strong. However, i advise caution for those who are trying to time and trade the market. Mr Market is irrational and the truth is that nobody actually knows what caused the market to crash an average of 6 % overnight. And nobody will know whether it will continue to plunge or do another meteoric rise from here.

Unless you belong to the less than 10% of super successful and nimble traders out there, my recommendation is to avoid short term trading and focus on your game plan to invest for the long term.

- Check your watchlist on the stocks of good businesses which will not only survive the pandemic, but thrive in the long run. These businesses most likely have strong product lines which consumers will need, solid cashflow and stable or growth in earnings.

- You will never be able to time the market bottom or top perfectly. Follow your game plan and enter the market in phases according to your portfolio sizing rules.

- Think long term. Great investors like Peter Lynch and Warren Buffett have timeless advice:

Warren Buffet: “Our favorite holding period is forever.”

Peter Lynch: “Holding investments for the long-term was the most effective strategy. The price at which you bought a share was not important. How long you held it was what mattered.”

I hope this post has prompted you to start thinking of what you should really be doing during the times when Mr Market becomes irrational and temperamental. Think of the dangers as opportunities.

Recent Comments