Wirecard had been in the news recently for the wrong reasons. The company, once a market darling, is now embroiled in a scandal, with 1.9 billion euros missing from its balance sheet.

This scandal adds to a long list of corporate frauds and insolvencies in the last two decades. The following are the biggest corporate scandals in the past twenty years.

List of biggest scandals since 2000

2001 – Enron

The directors and executives fraudulently concealed large losses in Enron’s projects. Enron’s share price went from $90.75 at its peak to $0.26 at bankruptcy.

2002 – Worldcom

The directors used fraudulent accounting methods to push up the stock price. At its peak, the company’s market capitalisation was $175 billion.

2008 – Lehman Brothers

The company betted heavily on mortgage debt. That resulted in its collapse when the subprime mortgages defaults started in 2007. Its eventual collapse intensified the 2008 crisis. During the crisis, trillions were erased in the market capitalization of equity markets.

2008 – Madoff

Madoff operated the largest Ponzi scheme in history and cheated investors out of $64.8 billion.

2020 – Wirecard

In June 2020, 1.9 billion Euros was found missing from the balance sheet. As a result, the company filed for insolvency on 25 June 2020.

Who is Wirecard?

Wirecard is a German fintech company. It processes payments and provides financial services. Due to its enormous growth story, it was once a market darling among analysts and investors. In just over a decade, it became one of Germany’s biggest companies.

As of 2018, Wirecard worked with more than 250,000 prominent companies. These included Allianz, VISA, Mastercard, Qatar Airways, KLM and many other household names.

In September 2018, Wirecard was listed on the prestigious DAX Index. At that time, Wirecard had a market capitalisation of Euro 22.5 billion.

In April 2019, Softbank invested $1 billion in Wirecard through a convertible bond, a type of debt that can be repaid in stock instead of cash.

The fall of Wirecard

The company admitted to being involved in multiyear accounting fraud. The final blow was the €1.9 billion missing from its balance sheet. This led to the arrest of the chief executive officer and the firm’s insolvency filing.

Investigations are still on-going. In the fall-out, there has been a lot of finger pointing. Some have blamed German regulator BaFin for its oversight failures. Others have pointed out the auditors, Ernst & Young, were liable too. However, Ernst & Young called it an “elaborate” fraud, which even a very rigorous probe may not have discovered.

Felix Hufeld, the president of German financial watchdog BaFin, said the Wirecard scandal was “a complete disaster” and “a shame” for Germany — a market that “should be governed by quality and reliability”.

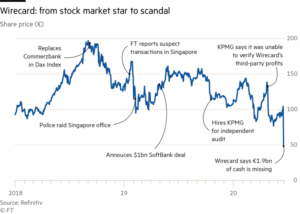

The following chart summarises the events leading to the eventual insolvency filing of Wirecard in end June 2020. Some of the key events were:

- Feb 2019 – Financial Times published an article alleging Wirecard Singapore of suspected practice of “round tripping”. As a result, there were a series of investigations after this.

- Feb 2019 – Singapore Police raided the Wirecard office following the Financial Times allegations.

- June 2020 – Officials in Munich questioned the Wirecard board on repeatedly delaying the release of its 2019 results.

- June 2020 – Ernst & Young auditors revealed that they had identified 1.9 billion euros missing from Wirecard’s accounts.

- 22 June 2020 – CEO Markus Braun was arrested on charges of inflating the company’s balance sheet.

- End June 2020 – Company filed for insolvency.

Lessons learnt

When we look at the Wirecard saga, most investors will probably be “blinded” by the fantastic growth story and balance sheet numbers that Wirecard presented. However, the first signs of trouble back in early 2019, as shown in the chart above, should have raised some red flags.

At the end of day, it is important to invest in companies and assets you understand and trust. If it’s too good to be true, it probably is.

Recent Comments