Investors always try to time the market to maximise their returns. Yesterday we saw another roller coaster ride in the market. The markets saw huge losses during Asia and early trading session in the U.S., but bounced back strongly on some positive news. Is it really possible to time the market or is it just a random walk in Wall Street?

What happened to the market?

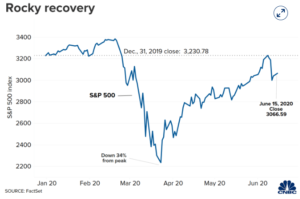

The Dow Jones Industrial Average closed 157.62 points higher on Monday. This was after the blue-chip index fell more than 760 points earlier in the session. The S&P 500 fell as much as 2.5% but gained 0.8% at then end of the session. Likewise, the Nasdaq Composite fell up to 1.9% and ended up 1.4% higher. All the early losses were erased by the end of the trading session.

The Federal Reserve said it would buy individual corporate bonds not just in the primary market. It would expand its scope to buying from the secondary market as well. This had remained a matter of speculation until Monday afternoon.

Source: Factset/CNBC

Fighting the 800 pound gorilla

Federal Reserve and the U.S. Government unleashed several rounds of measures to counter the effects of COVID-19 on the economy. This sparked the rally off the bottom formed on 23-Mar-2020.

Bears who had been calling this meteoric V-shape recovery a “dead cat bounce” had been time and again disappointed. The Fed has unlimited bullets in their arsenal and will spare no effort to ensure market is flushed with enough liquidity to stamp out the COVID-19 impact.

This reminds me of my school days when i was an avid gamer. I tried ways and means to hack the codes to get unlimited bullets and life. As a result, i was able to bulldoze my way through the dungeons to fight the “big bosses”. Nowadays, gamers pay cash to buy equipment to outfight their opponents and even trade the items for profits.

So it made me wonder if traders still have the edge in trying to time the market against an opponent who has unlimited ammunition.

Back to the basics

Instead of trying to time the market, seasoned investors will advocate spending time in the market. That is more likely to give you good returns over the long term. Base your investment decisions on the long-term fundamentals rather than short-term market noise.

Not only is it difficult to time the market, it also poses the risk of missing the good days when share prices increase significantly. Historically, many of the best days for the stock markets have occurred during periods of extreme volatility.

Stay focused on your game plan and continue to invest in businesses with good fundamentals. This will help you seize opportunities during this crisis to make some good returns over the long term.

Good sharing on investment techniques and knowledge. Dedicated in coaching on value investing. We had a fruitful and enjoyable 2 days online training. Very insightful and the strategies taught are very useful. Get to know new friends that have same interest. With the new knowledge, i will be able to push my investments to the next level. Really thanks to Yao Wen sifu selfless sharing, supportive and friendly guidance. Wish you good luck and stay motivated.

Hi Siew Siew, thanks very much for your kind remarks. I’m delighted to know you find the sharing useful. Continue to reach out if you have any questions.