Whenever friends and acquaintances ask me for tips on personal finances, I almost always share two things with them: the importance of personal budgeting, and working towards being debt free.

A personal budget is just like the company’s Annual Report. It gives you a very clear picture of the state of your finances. The way I look at it is similar to how I assess a company’s financials to determine if it is a good investment. The exercise goes beyond just tracking your income and expenses. It also has an impact on your “Balance Sheet” and “Cashflow”. It may sound like a chore and daunting exercise for many people. I will attempt to break it down in this article for you so that it can be a simple and meaningful exercise.

The key is to use a simple tracker, rather than complex spreadsheets and trackers. As with all things, start with a manageable tracker, refine it along the way and make it a habit to keep track.

The importance of budgeting is it provides the road map towards financial independence, allowing you to invest excess funds and grow your retirement nest.

Income Statement

Income statement is a nice sounding term to refer to your income vs expenses. Your personal income statement need not be as complicated as those of companies. All you really need to do is to separate the items into two major categories on a monthly basis:

You can break down your expenses into many sub-categories if you are someone who loves details. However, the idea is to start somewhere and get all those expenses listed in one place –it can even be on a piece of paper. You can then move on to the next step of populating them into the cashflow statement to determine if you are net positive or negative.

Cashflow Statement

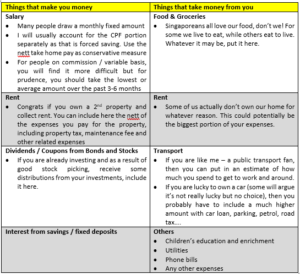

A personal cashflow statement measures the inflows (things that make you money) and outflows (things that take money from you).

If your cashflow statement is positive, congrats! It means you have surplus cash to utilise to pay down your loans (remember my debt free tip?), use as your emergency fund for a rainy day, or even to deploy into investments to grow your wealth.

If your cashflow statement is negative, it is time to start rationalising by cutting some of the “nice to haves” expenses and increase the percentage of savings (Income less Expenses).

People who have just started out in their careers and have lower income and more financial commitments will find it hard to save much. The idea is to start to track systematically and work towards your financial goals. People with good saving habits can even save up to 50% of their income without compromising their quality of life.

There is no right or wrong way to tabulate the cashflow statement. To help the newbies to my blog, I will suggest the following format attached to get you going. Basic personal budget_Emrich Investors

Balance Sheet

This is probably the most important and often overlooked part of your personal finances. It is like a report card that shows the results of your efforts to manage your income and expenses. There are quite a few perceptions which I usually hear which I would like to share:

- My car is my asset – or is it really a liability?

- My $1m house is my asset – but I still have an outstanding bank loan of $800,000. Is it really your asset or are you working for the bank (interest)?

- I don’t need to worry as I bought insurance – did you buy the right type of insurance and are you sure you have sufficient coverage during a rainy day?

- CPF is not my money and I can never touch it – it actually pays for a lot of your “things that take money from you” e.g. medical insurance premiums, home loans.

- Only 2 things in life are certain – Death and Taxes. Remember no matter what, you will still have to settle your tax liabilities.

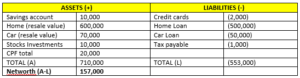

Rethink about the common questions above and determine whether the items are indeed your Assets or Liabilities. After which, I suggest the following simple format for you to tabulate and calculate your networth:

In the above example, we assumed the Home and car resale values are higher than the respective loans. We need to be aware that in downturn and times of distress, the asset prices can fall very quickly. That will result in you having a negative networth, which is a dire situation. That is also why I advise all my friends that one of their key financial objectives should include paying down the loans as soon as possible and be debt free.

Conclusion

I hope the above sharing helped you understand the importance of budgeting and encouraged you to start the process. Rome is not built overnight – you need to start with planning your finances to achieve your financial goals. Good luck!

Recent Comments