With the COVID-19 lock down and the global stock markets being sold down, many of us are bombarded with messages to “invest before it’s too late”. The economic outlook is not great, with potential pay cuts and retrenchments for many employees. As a result, some of us will start to reflect on the importance of having passive income stream. Putting money in your bank account is not the best option in the long run to beat inflation or reach your financial goals. However, the question often asked is how to start investing with little money?

Although people recognise the importance of investing and planning for future, but not many have the know-how and energy to review so much information to get started. Some others give themselves excuses like not having time and too little money to start start investing.

I will be introducing a few alternatives below for aspiring investors to explore on how to start investing with little money. However, it’s not a get rich quick scheme. In fact, I always tell people investing can be a boring game. But most of the time it is the boring stuff that really works in life.

-

Singapore Savings Bond (SSB)

Starting with as little as $500, you will be able to invest in AAA-rated bonds backed by the Singapore Government. These are bonds issued by the Singapore Government as a safe and flexible way for retail investors looking for long term saving of up to 10 years.

Some of the key advantages:

a) There is no penalty if you decide to liquidate your position early

b) Low entry level of as little as $500

c) Safe as it’s fully backed by Singapore Government

d) The longer you hold on to the bond, the higher interest you earn

e) It is easy to apply via ATM or Internet BankingDo visit Monetary Authority of Singapore website for more details on the SSB:

https://www.mas.gov.sg/bonds-and-bills/Singapore-Savings-Bonds -

Regular Shares Savings Plan (RSS)

RSS plans offers investors a disciplined way to set aside a small amount of money every month to invest in shares, REITs and ETFs. As a result, investors can avoid having to invest a lump sum and timing the market.

Some of the key advantages:

a) Don’t need to have huge amount of capital to start investing

b) New to investing and unsure what to invest in

c) Dollar cost averaging method to avoid trying to time the market

d) Cost efficientDo visit the SGX website for more details on the RSS:

https://www.sgxacademy.com/rssp/ -

Real Estate Investment Trust (REIT)

Owning a property had long been the Singaporean dream. Many investors also want to own 2nd, 3rd or more properties for rental income. However, property investing involves high amount of initial capital and significant amount of debt. In addition, due to the current measures of Additional Buyer Stamp Duty (ABSD) and Total Debt Servicing Ratio (TDSR), the capital outlay required is high.

A REIT is hence a good alternative for investors to get exposure to the real estate sector. For a fraction of the amount of owning a physical property, investors can buy into a portfolio of income-generating real estate assets.

The broad categories of assets are:

a) Shopping malls

b) Industrial buildings

c) Commercial & office space

d) Hotels

e) Data centers and othersInvestors will receive distributions (similar to dividends) at regular intervals, usually on a quarterly basis.

Some of the key things to look out for when investing in REITs include:

i) Distribution Per Unit (Yield %) which will normally be paid out quarterly

ii) Asset portfolio and occupancy rate

iii) Acceptable Price-to-book ratio

iv) Gearing ratioYou can refer to the attached publication from SGX on REITs in Singapore:

https://www.reitas.sg/wp-content/uploads/2019/07/SGX-Research-SREIT-Property-Trusts-Chartbook-July-2019.pdf -

Exchange Traded Fund (ETF)

There are more than 800 stocks listed on the Singapore Stock Exchange. Hence the question on how do you plough through the stocks to choose the right ones to buy?

Instead of trying to bet on one superstar company, some investors prefer to choose the sector, asset class (equity / bond etc) or even to invest in an entire economy. Hence, this is where ETFs will come in helpful. It is a listed fund which tracks the index or basket of diversified assets.

If you are planning to start investing in Singapore ETF, the widely discussed and popular ETF would be Straits Times Index (STI) ETF. It is a stock market index made up of the top 30 largest and most liquid listed companies in Singapore. Component stocks of STI includes DBS, OCBC, UOB, Singtel and more.

The links to the 2 main STI ETFs for your reference:

a) SPDR STI ETF (SGX: ES3) https://www.ssga.com/sg/en/individual/etfs/funds/spdr-straits-times-index-etf-es3

b) Nikko AM STI ETF (SGX: G3B) https://www.nikkoam.com.sg/etf/sti -

Central Provident Fund (CPF) Account

CPF forms the cornerstone of every Singapore investor’s portfolio. Apart from using CPF funds to pay for our homes, I believe there are areas that investors can look at to enhance returns.

a) Tax Relief

Topping up cash to your CPF not only helps to grow your retirement nest, but will also allow you to claim personal income tax relief. As a result, you will enjoy income tax savings especially if you belong to higher tax bracket.

Check out the IRAS website for details:

https://www.iras.gov.sg/IRASHome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals/CPF-Cash-Top-up-Relief/

b) Higher Interest

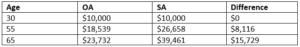

Some of us have excess funds in our Ordinary Account (OA) which we do not plan to use for purchasing a property or investing. Hence, it will make sense to transfer the balances from the OA to SA (Special Account) to enjoy the higher interest rate of 4% for SA balances.

Although the interest rate difference may seem small at 1.5% (OA earns 2.5%), the compounding effect over a long period of time can be significant. Please refer to the illustration below:

Check out the CPF website for details:

https://www.cpf.gov.sg/members/FAQ/schemes/retirement/retirement-sum-topping-up-scheme/FAQDetails?category=Retirement&group=Retirement+Sum+Topping-Up+Scheme&ajfaqid=2188830&folderid=19860

c) CPF Investment Scheme (CPFIS)

Investors who feel that the interest rates in their CPF balances are too low and wish to invest in higher yielding instruments can do so under the CPFIS. There is a range of permitted instruments for investors to choose from. As a result, this will overcome the issue of investors having to come up with cash to make their first investments.

Check out the CPF website for details on CPFIS:

https://www.cpf.gov.sg/Members/Schemes/schemes/optimising-my-cpf/cpf-investment-schemes

In conclusion, there are many alternatives available for investors to start investing with little money. The aim is to start small and gain valuable investing experience which will help you to achieve the desired financial goals.

Wish you a happy and fruitful journey into the world of investing!

Recent Comments